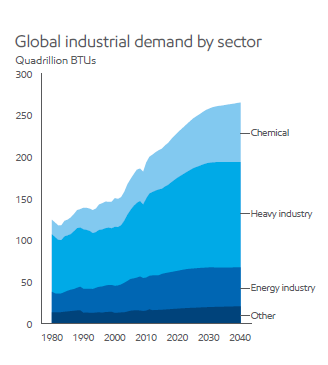

Industrial energy usage is projected to rise by 30 percent from 2014 to 2040, with the chemical sector leading the way, according to an ExxonMobil report released last month, “The Outlook for Energy: A View to 2040.”

Energy demand in the chemical sector will grow by about 50 percent over that period, driven by improving living standards in developing countries and robust shale gas supplies in the United States, the report said.

Rising prosperity is spurring demand for chemical products, including plastics, especially in China, India, Saudi Arabia and 10 “Key Growth” nations.* In the U.S., the chemical industry is expanding due to increased production of natural gas and natural gas liquids (NGLs), which are the main source of feedstock here.

Chemicals production is the fastest-growing source of industrial energy usage. Demand for plastics and other chemical products remains strong. - ExxonMobil, “The Outlook for Energy: A View to 2040”

Source: The Outlook for Energy: A View to 2040, ExxonMobil, January 25, 2016

In fact, increased natural gas supplies are shifting the global feedstock mix toward ethane and other NGLs. By 2040, NGLs and naphtha, an oil derivative that makes up 55 percent of today’s market, will be nearly equal.

ExxonMobil’s report supports the analysis of ACC economists, who are tracking announcements of shale-related chemical industry projects in the United States. At latest count, 266 projects representing $164 billion in cumulative investment have been announced, with 40 percent completed or under construction and 55 percent in the planning phase. The new factories and capacity expansions will create hundreds of thousands of well-paying jobs, strengthen communities and promote economic growth across the nation. A separate ACC report projected that U.S. jobs related to plastics manufacturing will grow by 462,000 over the next decade—more than 20 percent—reaching more than 2.7 million.

The ExxonMobil outlook reflects the positive news presented in a Nexant report commissioned by ACC, Fueling Export Growth: U.S. Net Export Trade Forecast for Key Chemistries to 2030. It projected that gross U.S. exports of chemical products, including plastics, will double from $60 billion in 2014 to $123 billion by 2030 thanks to plentiful and affordable natural gas.

Industry continues to “make more with less,” the new report found. The “energy intensity” of industrial production—energy consumed per dollar of GDP—is projected to continue its decline over the next 25 years. Average industrial energy intensity worldwide will improve by 40 percent between 2010 and 2040.

In the U.S. chemical industry, managing energy efficiency in our companies and manufacturing facilities is a key part of our commitment to sustainability. Through Responsible Care®, ACC members report on their progress toward a number of energy-related performance measures.

Industrial energy intensity in the OECD32 improved at about 2 percent per year from 1995 to 2010, a rate that is expected to continue through 2040. - ExxonMobil, “The Outlook for Energy: A View to 2040”

*Comprised of Brazil, Mexico, South Africa, Nigeria, Egypt, Turkey, Saudi Arabia, Iran, Thailand and Indonesia.