Exports of manufactured products have risen 6 percent since the start of America’s shale gas production boom, according to a new report by the International Monetary Fund (IMF). It’s a sign that plentiful, affordable natural gas – already a strong catalyst for chemical industry export growth – is benefiting U.S. manufacturing.

A reversal in U.S. chemicals trade balance

A reversal in U.S. chemicals trade balance

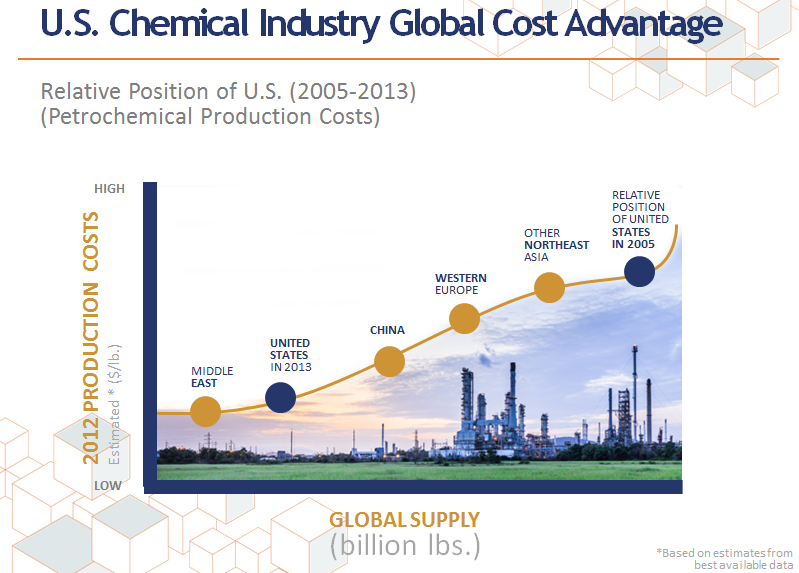

For the U.S. chemical industry, the shale gas revolution has lowered input costs, spurred demand for goods derived from chemicals in international markets, and created a huge competitive advantage. As one of the lowest-cost producers of key petrochemicals and resins today, the industry has gone from a trade deficit to a $3.4 billion surplus. By 2018, the trade surplus could reach $30 billion, according to ACC Economist Kevin Swift – a tenfold increase in five years.

The shale gas revolution is driving unprecedented chemical industry investment in the United States. As of this week, chemical companies have announced plans for 211 shale-related projects representing $135 billion in capital investment, much of it geared toward export markets. Fully 61 percent is foreign direct investment.

Meanwhile, America’s plastics makers have tripled their exports on half the energy, according to U.S. Energy Information Administration data released earlier this year.

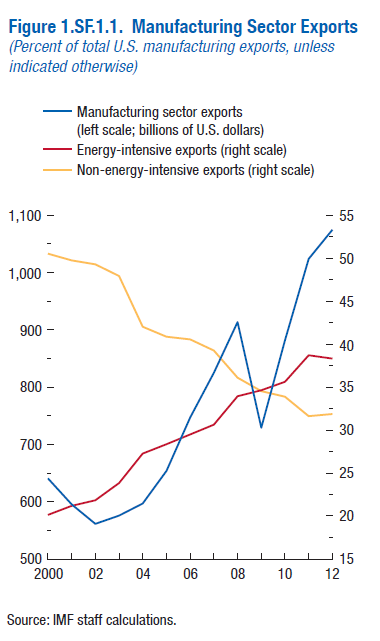

Energy-intensive manufacturing exports are growing

The graph at right shows how global trade in manufactured goods is being affected by the relatively lower cost of natural gas in the U.S. “Energy-intensive” items – those most affected by the cost and availability of energy – are a growing share of total U.S. manufacturing exports. Non-energy-intensive manufacturing is on the decline, according to the IMF report:

The main finding…is that the current gap between U.S. prices and those in the rest of the world has led to a 6 percent increase, on average,in U.S. manufactured product exports since the start of the shale gas boom… The lower natural gas price in the United States…has had a noticeable effect on U.S. energy-intensive manufacturing exports.

Thermoplastics exports share could surpass 30 percent by 2020

One tangible form of renewed petrochemical competitiveness is in trade of thermoplastics, which are used in automotive trim and parts, insulation, appliance parts, grocery bags, bottles, toys, pipe, siding, carpeting, wire and cable, medical disposables, and other applications.

From 2001-2006, exports of thermoplastics as a share of North American production averaged less than 13 percent, but as the shale gas revolution took hold, the figure began to rise, reaching 22 percent by 2009. This occurred even during the Great Recession, when global trade and industrial production slumped. When the economies of Europe and Japan fully recover, the combination of demand growth and renewed competitiveness are expected to push the export share above 30 percent by 2020.

Overall, ACC forecasts U.S. chemical exports to grow significantly in future years, surpassing $200 billion in 2014 and expanding nearly 8 percent annually through 2018. Leveraging the full potential of shale gas for U.S. chemical manufacturing, however, requires an ambitious trade agenda, including robust and comprehensive trade and economic partnerships that can expand access to overseas markets.

ACC has published a series of policy and regulatory recommendations on trade, energy and other issues that would improve the competitiveness of the U.S. chemical industry, reduce costs for domestic manufacturers, and lead to a significant increase in U.S. exports. Such changes would lead to $58 billion in export growth for the chemical industry alone.

With an economy still trying to inch its way back to pre-2008 conditions, every billion counts.