For U.S. chemical manufacturers to succeed in today’s global economy, they must be able to compete effectively in international markets. This requires an ambitious trade agenda, including robust and comprehensive trade and economic partnerships, that can deliver enhanced access to overseas markets.

In a welcome development, the role of trade in driving and reinforcing economic growth has come into sharper focus over the past month.

The Senate Finance Committee and House Committee on Ways and Means held hearings to explore the Administration’s trade policy agenda, with a keen eye toward finalizing negotiations on a Trans-Pacific Partnership (TPP) and advancing the Trans-Atlantic Trade and Investment Partnership (TTIP). The committees also reviewed post-Doha negotiations at the World Trade Organization (WTO), which has instilled new confidence in the WTO’s ability to agree to new global trade rules.

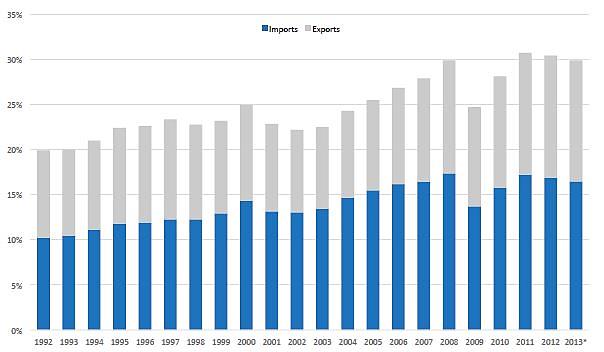

The U.S. economy has become more dependent on international trade as a source for market export growth and job creation. As illustrated in the graph below, total trade in goods and services holds a significant share of U.S. gross domestic product (GDP), and FTAs continue to be one of the most promising avenues for driving robust economic growth.

U.S. TRADE INTENSITY (EXPORTS & IMPORTS)

Total Value of Traded Goods & Services as a Share of GDP

Acknowledging the key role of FTAs in promoting economic growth, ACC strongly supports a robust, agile U.S. trade agenda that includes a high-standard, comprehensive and commercially meaningful TTIP and TPP agreements.

The business of chemistry in the United States is in the midst of an unprecedented boost in competitiveness, largely due to the increased supply of low-cost natural gas, a feedstock and a power source for chemical manufacturing. More than US$100 billion in new investments or expansions of existing facilities have been announced as a result of this boom, around half of which is foreign direct investment.

ACC forecasts U.S. chemical exports to grow significantly in future years, surpassing US$200 billion in 2014 and expanding nearly 8 percent per year through 2018. This makes the search for new markets, and the reduction or elimination of trade barriers in existing ones a core priority for U.S. chemical manufacturers. An ambitious TPP and TTIP will help the industry capitalize on recent expansion and promote economic growth and job creation, enhance U.S. competitiveness, and expand consumer choice.

View ACC’s report, “Keys to Export Growth for the Chemical Sector”

None of this will be possible, however, if Congress does not grant President Obama Trade Promotion Authority (TPA). TPA ensures that completed agreements will be subject to an up or down vote in Congress – and nothing more. This is important because, in the absence of TPA, negotiating partners are unlikely to put their best offers on the table, knowing that Congress could strip them from the final agreement.

As part of a comprehensive trade agenda for 2014, ACC also strongly encourages the U.S. government to continue to play a strong leadership role in both the WTO, and other trade forums, such as the Asia-Pacific Economic Cooperation (APEC). Taken together, the U.S. trade agenda has the capacity to result in some of the most groundbreaking and complex outcomes since NAFTA and the GATT Uruguay Round in the early-mid 1990s.

That’s why ACC welcomes the opportunity to work with Congress and the Administration to ensure that this ambitious trade agenda delivers on its promise.